Modification of contractual cash flows

Modification due to renegotiation

When the contractual cash flows of a financial asset are renegotiated or otherwise modified and the renegotiation or modification does not result in the de-recognition of that financial asset, an entity shall recalculate the gross carrying amount of the financial asset and shall recognise a modification gain or loss in profit or loss. The gross carrying amount of the financial asset is recalculated as the present value of the renegotiated or modified contractual cash flows that are discounted at the financial asset’s original effective interest rate (or credit-adjusted effective interest rate for POCI financial assets) or, when applicable, the revised effective interest rate calculated after a fair value hedge. Any costs or fees incurred adjust the carrying amount of the modified financial asset and are amortised over the remaining term of the modified financial asset.

Modification due to revision in estimates

If an entity revises its estimates of payments or receipts (excluding modification due to renegotiation) and changes in estimates of expected credit losses), it should adjust the gross carrying amount of the financial asset or amortised cost of a financial liability (or group of financial instruments) to reflect actual and revised estimated contractual cash flows. The entity recalculates the gross carrying amount of the financial asset or amortised cost of the financial liability as the present value of the estimated future contractual cash flows that are discounted at the financial instrument’s original effective interest rate (or credit-adjusted effective interest rate for POCI financial assets) or, when applicable, the revised effective interest rate calculated after a fair value hedge. The adjustment is recognised in profit or loss as income or expense.

Example

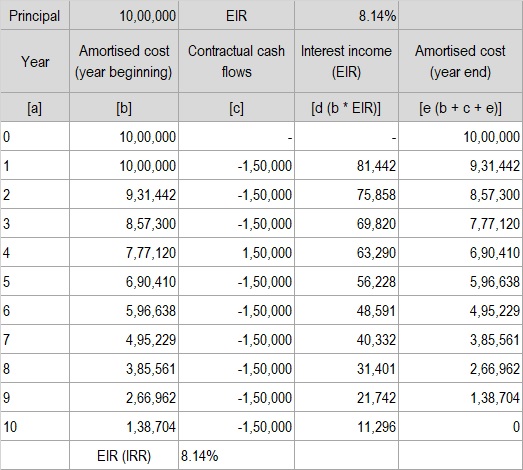

An entity gives a loan of Rs 10,00,000 with repayment being Rs 1,50,000 every year for the next 10 years starting from the end of the first year. Calculate the effective rate of interest.

Solution

The IRR for the cash flows translates into an effective interest rate of 8.1442% and the entity will account for the interest income based on the effective interest rate as shown in the table below.

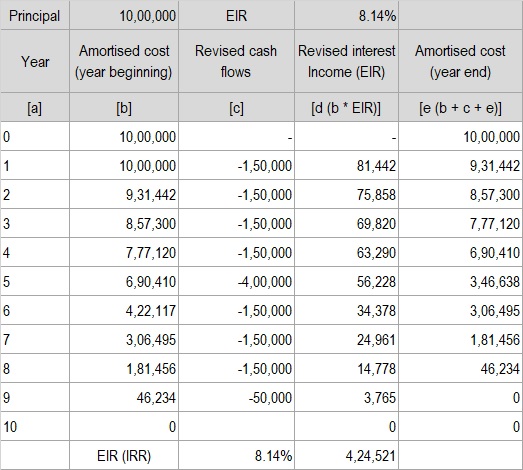

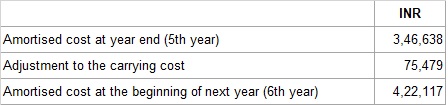

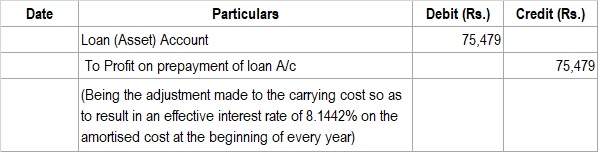

Modified cash flows and adjustment to carrying cost:

Assuming that the borrower returns Rs 2,50,000 over and above Rs 1,50,000 at the end of the fifth year, compute the adjustment to be made to the amortised cost of the loan.

Since the borrower returns Rs 4,00,000 at the end of fifth year, the entity should revise the interest income in such a way that the interest income continues to work out to the same IRR of 8.1442%. The workings are given below and the entity will pass the following journal entry. The revised interest income is also shown in the table below.

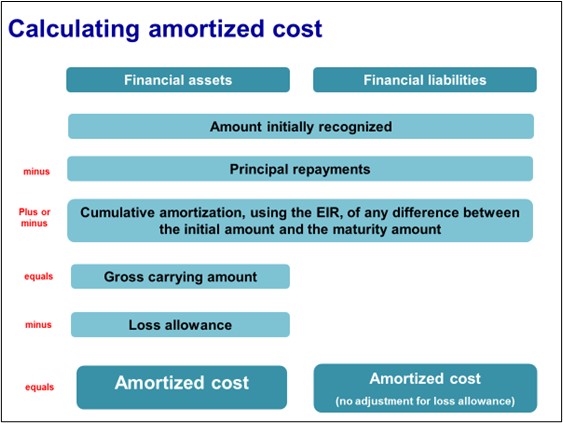

Amortized Cost computation for financial instruments

Financial Assets

The amortised cost for financial assets is computed as under:

Example 1:

X Ltd lent Rs 100,000 for two years to Mr Y with an EMI of Rs 5,000. The EIR (IRR) of this cash flow structure is 1.51% pm or 18.56% pa.

In this case, at the end of the sixth month, the amortized cost of the asset is 78,271.

Example 2:

Information as in Example 1 above, except that on maturity there will be a premium charge of, Rs 7,000. The EIR (IRR) of this cash flow structure is 1.91% pm or 22.91% pa.

In this case, at the end of the sixth month, the amortized cost of the asset is 80,545.

Financial Liabilities

The computation of the amortised cost for financial liabilities is similar to that of financial assets except there is no deduction for loss allowance.

Calculating amortized cost

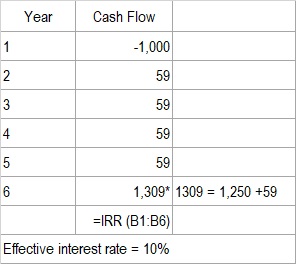

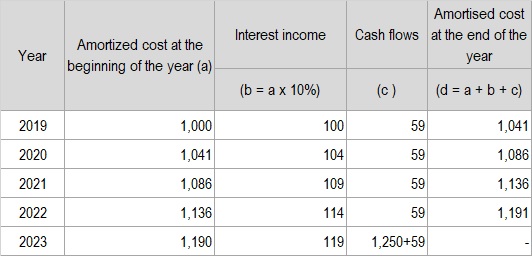

Illustration

A Ltd. purchases a debt instrument with five years remaining to maturity for its fair value of Rs 1,000 (including transaction costs). The instrument has a principal amount of Rs 1,250 and carries fixed interest of 4.7% that is paid annually (Rs 1,250 x 4.7% = Rs 59 per year). Compute the amortized cost for the period of the debt instrument.

Solution

Recognition of interest revenue

Interest revenue shall be calculated by using the effective interest method. This shall be calculated by applying the effective interest rate to the gross carrying amount of a financial asset.

For purchased or originated credit-impaired (POCI) financial assets, the entity should apply the credit-adjusted effective interest rate to the amortised cost of the financial asset from initial recognition.

For financial assets that are not POCI financial assets but subsequently have become credit-impaired financial assets, the entity should apply the effective interest rate to the amortised cost of the financial asset in subsequent reporting periods.

Effective Rate of Interest – EIR

Are RBI circulars relevant for ECL computation as per Ind AS 109?

What is a Financial instrument?

Is there a choice to designate as FVTPL?

What are treasury shares and how are these presented

Contract to deal in non-financial item

Can a corporate entity still follow settlement date accounting?

Gains and losses on assets measured at FVOCI

Separately accounting for an embedded derivative

Derecognition of a financial asset

Foreign currency risk in a firm commitment as a fair value hedge

Treatment of transaction costs

Derecognise financial assets/financial liabilities retrospectively

Own use exemption as per the Accounting Standard

Difference between amortised cost & held-to-maturity

Accounting treatment for FVOCI Instruments

What is the concept of effective interest method?

First-time adoption while classifying a financial instrument

SPPI test & business model objective test

Current standards for financial instruments as per AS?

Contract is settled through the entity’s own equity instrument

Financial asset categorised as FVOCI

What is an embedded derivative?

Impairment model for different categories of financial assets

Ind ASs relating to financial instruments

FVOCI (equity instruments) and FVOCI (debt instruments)

Classification of derivative instruments

Reclassification of a financial asset

Debt instrument measured at FVOCI

Change in contractual cash flows

Loss allowance as per Ind AS 109

Ind AS for financial instruments replica of IFRS?

Contractual cash flows & effective interest rate

Long-term financial liability classified as FVTPL

Credit adjusted effective interest rate

Effective rate of interest during the first-time adoption

Consequence of not de-recognising an asset after the sale

Designation of contracts deal a non-financial item on first time adoption

Recognition of financial instruments on first-time adoption

Gains and losses on a financial instrument

Gains and losses from liabilities designated as FVTPL

Measurement categories for financial assets

Difference between time value of money and modified time value of money